Hope Hicks testifies at Trump trial about fallout from "hush money" payments

Hope Hicks, who was one of former President Donald Trump's closest aides for years, has been called to the stand to testify at Trump's criminal trial in New York.

Watch CBS News

Hope Hicks, who was one of former President Donald Trump's closest aides for years, has been called to the stand to testify at Trump's criminal trial in New York.

The Texas dairy worker infected by H5N1 "did not disclose the name of their workplace," frustrating investigators.

Democratic Rep. Henry Cuellar of Texas was elected to the House in 2005 and represents the state's 28th Congressional District.

Massachusetts investigators uncover a suspicious web history after Brian Fanion reports his wife Amy's death as a suicide.

President Biden will award the Presidential Medal of Freedom, the nation's highest civilian honor, to 19 recipients on Friday.

Bryan Kohberger's attorney Anne Taylor said that prosecutors have not provided the full video that shows his car near the residence where four University of Idaho students were killed.

Ex-government employee Miguel Zapata with tie is accused of sending fake FBI tips falsely accusing multiple coworkers of taking part in the Jan. 6, 2021, Capitol breach.

The substance was found during a 2023 excavation of a Roman bathhouse.

Russia says the French president's remarks about a hypothetical troop deployment to Ukraine are "very important and very dangerous."

The 2024 Kentucky Derby will be the 150th running of the high-profile race.

James Craig's lawyers have argued there is no direct evidence that he put poison in his wife's protein shakes.

Australian brothers Jake and Callum Robinson and their American friend have not been seen since April 27.

There's a newly-determined "major factor" in declining bumblebee populations – and it's attacking their nests.

Sidechat, an anonymous messaging app, has been used by students to share opinions and updates, but university administrators say it has also fueled hateful rhetoric.

The woman — identified by the Brussels Times as Annie De Poortere — disappeared on November 12, 1994.

Usher Weiss, 26, must pay a $5,000 fine and surrender all contraband.

Preview: More than a decade after a stroke robbed the country artist of his cherished singing voice, computer technology has helped create his new single, "Where That Came From."

Marc Summers says bringing his play to New York City has been a "dream," after a career that's often has played out in front of a live audience.

Lawyers from Manhattan DA Alvin Bragg's office told the judge Trump had violated the gag order four more times.

Prosecutors in former his "hush money" criminal trial in New York called their fifth witness to the stand.

She sent a letter to the Justice Department's Office of Professional Responsibility calling on it to open the investigation.

The GOP candidate with the most votes in the primary said she's suspending her campaign.

The ad features part of Donald Trump's interview with Time Magazine.

Several New York Democrats acknowledged that Republicans are more aggressively counterpunching on the issue.

The hostage and cease-fire talks have taken on new urgency amid a looming Israeli ground invasion of Rafah, in southern Gaza.

They're spreading far beyond the U.S.

Israeli Prime Minister Netanyahu publicly rejects international pressure to call off an offensive on the southern Gaza city.

There's a compelling case to be made for choosing a high-yield savings account over a CD this season.

Are you thinking about paying your mortgage off with your home equity? Here are pros and cons to consider first.

Bankruptcy and debt settlement are both effective ways of getting rid of debt, but which one makes more sense?

Job site Indeed identified the top 10 most sought-after job candidates by employers and recruiters. Here's what they found.

Audit firm BF Borgers allegedly failed to comply with accounting standards and fabricated audit documentation, regulators claim.

U.S. unemployment rate rose slightly to 3.9% in April, continuing a stretch of remaining under 4% for 27 months.

A lawsuit says if emergency responders had known about widespread cellphone outages during the deadly Maui wildfires, they would've used other methods to warn about the disaster.

The IRS is tapping Inflation Reduction Act funding to hire more agents and go after more tax cheats. Here's where it is focusing.

Keep track of every Indiana Fever game this season and watch Caitlin Clark's WNBA debut.

We found top-rated TVs from Samsung, LG, Sony and more on sale at Walmart ahead of Memorial Day.

[SPONSORED CONTENT] Snag a great Best Buy deal on a Tineco floor washer that can do it all. But hurry -- this sale won't last.

River and lake levels are rising and are expected to crest Friday night as flooding gets worse in southeast Texas. Many roads in the region are swamped, making driving impossible.

Keith Davidson, Stormy Daniels’ former lawyer, testified about arranging a $130,000 payment from Trump’s former lawyer and fixer Michel Cohen to the adult film star to stay quiet about an alleged sexual encounter with Trump.

On Monday, Boeing plans to launch astronauts on its new spacecraft that is called Starliner. The test flight to the International Space Station is years behind schedule.

For the first time ever, the country’s top teachers were invited to a state dinner at the White House to honor their work. First lady Jill Biden, who made the announcement last month on “CBS Mornings,” hosted the special event for the state and national teachers of the year.

Comedian Steve Martin and filmmaker Morgan Neville sit down with Tracy Smith to discuss their documentary “STEVE! (martin) a documentary in 2 pieces."" Then, Nancy Giles meets birder Christian Cooper in Central Park. “Here Comes the Sun” is a closer look at some of the people, places and things we bring you every week on “CBS Sunday Morning.”

Author Nicholas Sparks and the members of the creative team of “The Notebook” sit down with David Pogue to discuss the development of the famous novel into a Broadway musical. Then, Lee Cowan visits Vashon Island, Washington, to meet Thomas Dambo, the creator of wooden trolls. “Here Comes the Sun” is a closer look at some of the people, places and things we bring you every week on “CBS Sunday Morning.”

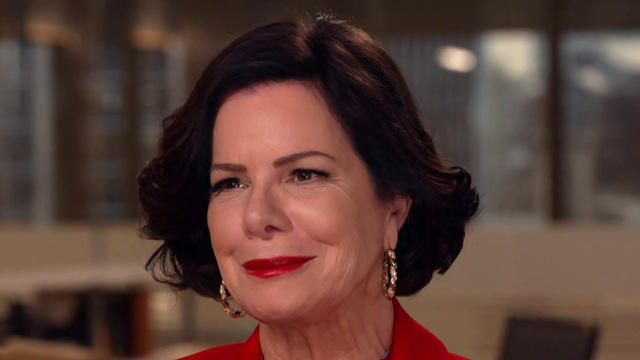

Actor Marcia Gay Harden sits down with Seth Doane to discuss her CBS series "So Help Me Todd," her LGBTQ+ activism and her love of pottery. Then, Jonathan Vigliotti meets Julian Curi, the filmmaker behind the short film "Gruff." "Here Comes the Sun" is a closer look at some of the people, places and things we bring you every week on "CBS Sunday Morning."

Comedian and actor Kevin James sits down with Jim Axelrod to discuss his Amazon Prime special "Kevin James: Irregardless,” and the journey he has taken throughout his career. Then, Robert Costa visits the National Gallery of Art in Washington, D.C., to view an exhibit on artist Mark Rothko’s work. “Here Comes the Sun” is a closer look at some of the people, places and things we bring you every week on “CBS Sunday Morning.”

Actor Paul Giamatti sits down with Lesley Stahl to discuss his latest film, “The Holdovers,” as well as other characters he has portrayed throughout his career. Then, Seth Doane travels to the Musée d’Orsay in Paris to learn about the AI-generated avatar of Vincent Van Gogh. “Here Comes the Sun” is a closer look at some of the people, places and things we bring you every week on “CBS Sunday Morning.”

Jordan’s Queen Rania Al Abdullah, who is of Palestinian descent, says Israel’s allies need to hold Israel accountable for its actions. She spoke with “Face the Nation” moderator Margaret Brennan about the U.S. support for Israel in the war against Hamas.

Actress Halle Berry joined with a group of bipartisan senators on Thursday to announce new legislation to promote menopause research, training and education.

Still searching for the perfect Mother’s Day gift? Sarah Gelman, Amazon Books Editorial Director, shares her top book picks for all kinds of moms.

The students participated in a field day where they had a chance to go on the obstacle course, grab a bow and arrow and shoot at the archery range, and tryout adaptive cycles for the launch of the new adaptive program.

Judi Dench has tackled nearly every female role in William Shakespeare's plays, from Juliet to Cleopatra.

In Oklahoma, Nate Burleson shares his family’s personal connection to one of America’s darkest chapters. Then in Texas, we tour the renowned Kinsey Collection, the largest private holding of African American art and artifacts. Watch these stories and more on Eye on America with host Michelle Miller.

In California, we dine out at a restaurant powered by robots. Then in Washington, we take a sip of a beanless cup of coffee, which aims to reduce the environmental impact of the popular beverage. Watch these stories and more on "Eye on America" with host Michelle Miller.

In New York, we tour a unique museum that’s home to an extensive collection of toys, games and playgrounds. Then, we sit down with NBA superstar Steph Curry to discuss his heartwarming new children’s book. Watch these stories and more on "Eye on America" with host Michelle Miller.

In Arizona, we learn why flag football is becoming an increasingly popular sport, especially among girls. Then in New York, we meet with descendants of some of the most notable suffragists of the 20th century. Watch these stories and more on "Eye on America" with host Michelle Miller.

In Connecticut, we meet the preservationists who are giving dilapidated lighthouses new life. Then in California, we learn about the efforts to restore an iconic fishing boat. Watch these stories and more on "Eye on America" with host Michelle Miller.

Back in March, two officers and a good Samaritan risked their lives to rescue a couple who were trapped in a burning home in Cape Coral, Florida.

A police officer becomes a guardian angel for a little girl struggling at school. A New Jersey toddler goes viral for the way she speaks, bringing joy and laughs to millions. A 7-year-old makes history at the rodeo. Plus, more inspiring stories.

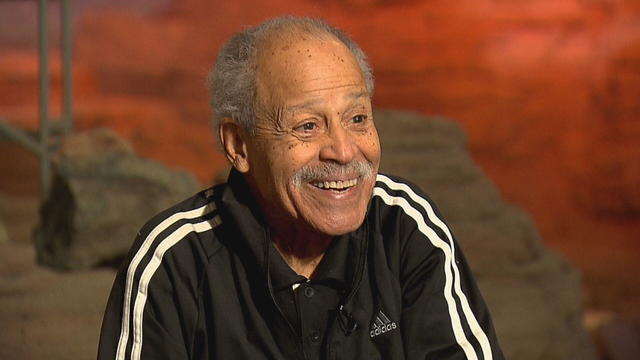

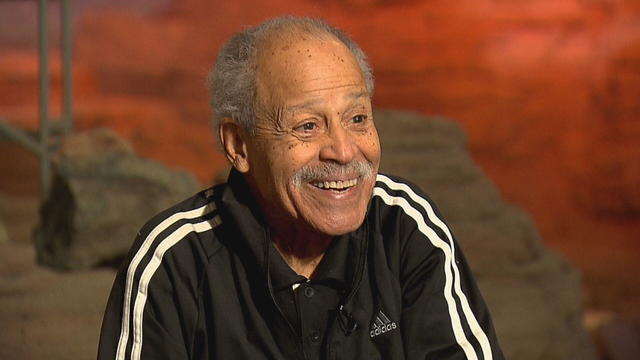

In 1961, Ed Dwight was selected by President John F. Kennedy to enter an Air Force training program known as the path to NASA's Astronaut Corps. But he ultimately never made it to space.

At his lowest moment, U.S. Army veteran and former teacher Billy Keenan found strength in his faith as he was reminded of his own resilience.

A surfing accident left New York teacher Billy Keenan paralyzed, but when he received a call from a police officer, his life changed.

Romance scammers drain billions of dollars from people seeking love, and their tactics have evolved in sinister ways in the online age. CBS News goes inside this devastating epidemic unfolding largely in secret, following the journey of an Illinois woman seeking answers after her mother’s mysterious death.

CBS Reports goes to Illinois, which has one of the highest rates of institutionalization in the country, to understand the challenges families face keeping their developmentally disabled loved ones at home.

As more states legalize gambling, online sportsbooks have spent billions courting the next generation of bettors. And now, as mobile apps offer 24/7 access to placing wagers, addiction groups say more young people are seeking help than ever before. CBS Reports explores what experts say is a hidden epidemic lurking behind a sports betting bonanza that's leaving a trail of broken lives.

In February 2023, a quiet community in Ohio was blindsided by disaster when a train derailed and authorities decided to unleash a plume of toxic smoke in an attempt to avoid an explosion. Days later, residents and the media thought the story was over, but in fact it was just beginning. What unfolded in East Palestine is a cautionary tale for every town and city in America.

In the aftermath of the Supreme Court striking down affirmative action in college admissions, CBS Reports examines the fog of uncertainty for students and administrators who say the decision threatens to unravel decades of progress.

The hostage and cease-fire talks have taken on new urgency amid a looming Israeli ground invasion of Rafah, in southern Gaza.

Audit firm BF Borgers allegedly failed to comply with accounting standards and fabricated audit documentation, regulators claim.

Massachusetts investigators uncover a suspicious web history after Brian Fanion reports his wife Amy's death as a suicide.

James Craig's lawyers have argued there is no direct evidence that he put poison in his wife's protein shakes.

The Texas dairy worker infected by H5N1 "did not disclose the name of their workplace," frustrating investigators.

Audit firm BF Borgers allegedly failed to comply with accounting standards and fabricated audit documentation, regulators claim.

U.S. unemployment rate rose slightly to 3.9% in April, continuing a stretch of remaining under 4% for 27 months.

Job site Indeed identified the top 10 most sought-after job candidates by employers and recruiters. Here's what they found.

Peloton CEO Barry McCarthy exits as it lays off more staff. What's ailing the fitness company?

A Georgia senior living community fired an elderly worker shortly after honoring her as an employee of the year, regulators allege.

The hostage and cease-fire talks have taken on new urgency amid a looming Israeli ground invasion of Rafah, in southern Gaza.

Democratic Rep. Henry Cuellar of Texas was elected to the House in 2005 and represents the state's 28th Congressional District.

Ex-government employee Miguel Zapata is accused of sending fake FBI tips falsely accusing multiple coworkers of taking part in the Jan. 6, 2021, Capitol breach.

Roughly 100,000 immigrants who were brought to the U.S. as children are expected to enroll in the Affordable Care Act's health insurance next year under a new administration rule, the White House says.

Hope Hicks, who was one of former President Donald Trump's closest aides for years, has been called to the stand to testify at Trump's criminal trial in New York.

The Texas dairy worker infected by H5N1 "did not disclose the name of their workplace," frustrating investigators.

Stress is hard to avoid, but experts say getting outdoors can have a positive impact on both our mental and physical health.

Actress Halle Berry joined with a group of bipartisan senators on Thursday to announce new legislation to promote menopause research, training and education.

New CDC data shows about 680 women in the U.S. died during pregnancy or shortly after childbirth in 2023, a decline from the previous year.

UnitedHealth Group CEO Andrew Witty disclosed that a cyberattack on one of its subsidiaries earlier this year might affect up to a third of all Americans.

The substance was found during a 2023 excavation of a Roman bathhouse.

The woman — identified by the Brussels Times as Annie De Poortere — disappeared on November 12, 1994.

Former U.K. Prime Minister Boris Johnson was turned away from a polling station for failing to bring a photo ID - required under a law introduced by his government.

Russia says the French president's remarks about a hypothetical troop deployment to Ukraine are "very important and very dangerous."

Australian brothers Jake and Callum Robinson and their American friend have not been seen since April 27.

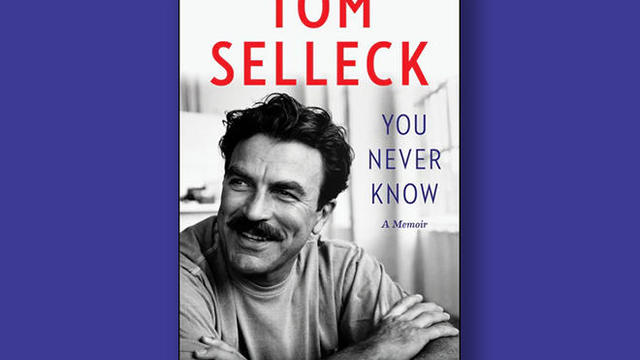

In his new memoir the star of such hit TV series as "Magnum, P.I." and "Blue Bloods" writes of the serendipity that launched his career.

Preview: More than a decade after a stroke robbed the country artist of his cherished singing voice, computer technology has helped create his new single, "Where That Came From."

Marc Summers says bringing his play to New York City has been a "dream," after a career that's often has played out in front of a live audience.

Kiki Wong got her first guitar from Costco at 13 years old. Now she's joining The Smashing Pumpkins.

The classic kids' game show "Double Dare" premiered in 1986, and was a massive success for Nickelodeon, which became one of the biggest cable channels of the 1990s. Behind much of that success was TV host Marc Summers. He's enjoyed a long career in front of and behind the camera, hosting and producing shows for Nick, Food Network and others. "CBS Mornings" met with the 72-year-old on the set of his new one-man play in New York City, called "The Life and Slimes of Marc Summers."

Microsoft users can now use biometric passkeys, like a thumbprint or Face ID, to sign into Microsoft 365, Copilot. Jon Fingas, senior editor at Techopedia, has more.

Sidechat, an anonymous messaging app, has been used by students to share opinions and updates, but university administrators say it has also fueled hateful rhetoric.

From labor shortages to environmental impacts, farmers are looking to AI to help revolutionize the agriculture industry. One California startup, Farm-ng, is tapping into the power of AI and robotics to perform a wide range of tasks, including seeding, weeding and harvesting.

Georgia is home to the nation's newest nuclear reactor. It's bringing clean energy to the state, but the project has run over budget and past its original completion date. Drew Kann, climate and environment reporter for The Atlanta Journal-Constitution, joins CBS News to explore the effort.

Google made its closing arguments Thursday in the antitrust case brought by the Department of Justice. CBS News senior business and tech correspondent Jo Ling Kent reports.

There's a newly-determined "major factor" in declining bumblebee populations – and it's attacking their nests.

On Monday, Boeing plans to launch astronauts on its new spacecraft that is called Starliner. The test flight to the International Space Station is years behind schedule.

Georgia is home to the nation's newest nuclear reactor. It's bringing clean energy to the state, but the project has run over budget and past its original completion date. Drew Kann, climate and environment reporter for The Atlanta Journal-Constitution, joins CBS News to explore the effort.

For the first time since 1803, two groups of periodical cicadas are emerging from the ground at the same time in parts of the Midwest and South. However, a small section of Central Illinois marks the only place where both the 13-year and 17-year cicadas are emerging in the same place. Dave Malkoff reports on the extraordinary event.

Much of Asia is sweltering under a heat wave that one expert calls "by far the most extreme event in world climatic history."

Massachusetts investigators uncover a suspicious web history after Brian Fanion reports his wife Amy's death as a suicide.

James Craig's lawyers have argued there is no direct evidence that he put poison in his wife's protein shakes.

The woman — identified by the Brussels Times as Annie De Poortere — disappeared on November 12, 1994.

Usher Weiss, 26, must pay a $5,000 fine and surrender all contraband.

Bryan Kohberger's attorney Anne Taylor said that prosecutors have not provided the full video that shows his car near the residence where four University of Idaho students were killed.

It is the latest advance in China's increasingly sophisticated space exploration program, which is now competing with the U.S.

Boeing is set to launch its first-ever spaceflight with humans next week. The Starliner spacecraft will lift off from Florida on Monday night for a multi-day mission to the International Space Station. Commander Barry "Butch" Wilmore and pilot Sunny Williams, two seasoned NASA astronauts who are a part of the mission, join CBS News to go over the flight.

The Horsehead Nebula, which NASA has called "one of the most distinctive objects in our skies," is located in the constellation Orion.

Astronauts Barry Wilmore and Sunita Williams say they have complete confidence in the Starliner despite questions about Boeing's safety culture.

In 1961, Ed Dwight was selected by President John F. Kennedy to enter an Air Force training program known as the path to NASA's Astronaut Corps. But he ultimately never made it to space.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

When Tiffiney Crawford was found dead inside her van, authorities believed she might have taken her own life. But could she shoot herself twice in the head with her non-dominant hand?

We look back at the life and career of the longtime host of "Sunday Morning," and "one of the most enduring and most endearing" people in broadcasting.

Cayley Mandadi's mother and stepfather go to extreme lengths to prove her death was no accident.

People from all around the world will celebrate "Star Wars" Day on Saturday, May the Fourth. The franchise has captivated fans for decades, generated billions of dollars at the box office and has seen several successful spinoffs. Dan Zehr, co-author of "The Star Wars Book," joined CBS News to talk about the day and the movie.

As the American wealth gap continues to widen, Jon Wertheim has, for the last year, been looking at an unlikely effort to get more money in the hands of rank-and-file workers. Sunday.

Israeli officials said they believe one of the remaining hostages, Dror Or, was killed during the Oct. 7 attack and that his body is being held in Gaza. BBC News correspondent Frank Gardner joined CBS News with more.

The U.S. Space Force was established in 2019, creating the first new branch of the armed services since 1947. Its mission is to protect critical assets Americans have come to depend on like GPS and weather satellites while also providing space capabilities to the joint forces. U.S. Space Force Chief Master Sergeant John F. Bentivegna joined CBS News to discuss how the branch is used.

Former President Donald Trump is set to headline the Republican National Committee's spring donor retreat in Florida this weekend. Some potential vice presidential picks are expected to attend, including Sens. Marco Rubio, Tim Scott and J.D. Vance, along with North Dakota Gov. Doug Burgum. Republican strategist Leslie Sanchez and Democratic strategist Joel Payne joined CBS News to discuss that and the rest of the week's political news.