Democrats who investigated Trump expect to face retaliation if Trump wins

Democrats who led probes into Trump's role in Jan. 6 Capitol riot expect to face arrest if he wins: "Anybody who has testified against him...should be worried."

Watch CBS News

Democrats who led probes into Trump's role in Jan. 6 Capitol riot expect to face arrest if he wins: "Anybody who has testified against him...should be worried."

Neither Iran's leaders nor its people appear fearful of an imminent Israeli counterstrike, but they all know the real risks of a war.

The Senate is set to convene for the impeachment trial of Secretary Alejandro Mayorkas on Wednesday afternoon, with Democrats aiming to bring the effort to a quick end.

British lawmakers have backed legislation that would see the legal age to buy tobacco increase by one year every year until it's eventually banned.

Uri Berliner, who has worked at NPR for 25 years, was suspended after he claimed the network pushed progressive viewpoints.

O.J. Simpson's longtime lawyer in Las Vegas says the end came quickly.

It took decades to identify the remains, and an investigation into the case is still ongoing.

A bipartisan group of lawmakers sent a letter to President Biden calling for "renewed assessment by the U.S. government" of Havana Syndrome in the wake of 60 Minutes' latest report on "anomalous health incidents."

Dubai International Airport is urging travelers to stay away as flooding from "a historic weather event" hobbles the arid United Arab Emirates.

A book with records of a U.S. Navy destroyer's trips during World War II was found in a piece of furniture far from the now-sunken ship.

Officials reported "volcanic ash rain" as photos and videos show the Ruang volcano filling the night sky with fiery red and orange plumes.

The new single, titled "Primrose Hill", was recently released by James McCartney and Sean Ono Lennon, who are both musicians themselves.

It was unclear whether the cold-blooded commuter was venomous or how it ended up on the train, a spokesman said.

Hilarie Burton Morgan said personal connections to the government and law enforcement communities inspired her involvement in true crime.

The campaign will work with private and public sector partners to combat rising rates of child exploitation and abuse online.

A financial counselor for the U.S. Army has admitted to tricking the surviving beneficiaries of fallen soldiers out of millions while profiting himself.

Salvatore Rubino kicked illegal gambling profits to the Genovese crime family, prosecutors say.

A new generation of deodorant products promise whole-body odor protection. Should you try one? Dermatologists share what to know.

CBS News Confirmed examines three viral claims that have emerged so far during Trump's first criminal trial.

Trump's trial will feature a unique cast of characters.

The case stems from a "hush money" payment of $130,000 to adult film star Stormy Daniels in 2016.

Trump's allies are encouraging foreign countries to send emissaries to Mar-a-Lago to reconnect ahead of another potential Trump stint in the White House, sources confirmed.

President Biden believes painting former President Trump as a "threat" to democracy is a crucial contrast to highlight in his campaign.

The casll came in a joint statement by twelve major news organizations including CBS News.

UNICEF says a third of Gaza's infants and toddlers are acutely malnourished, but Israel blames the U.N. itself.

Details emerge of Iran's unprecedented direct attack on Israel, and how it was largely thwarted by the U.S. ally's defenses.

President Biden and Israeli Prime Minister Benjamin Netanyahu had a "good conversation," an official said.

Are you looking for the biggest bank account bonus possible? Consider these leading options.

A home equity loan can make sense when you want a fixed-rate loan and a lump sum of money to borrow.

High-yield savings accounts offer unique benefits that are great for short-term savings.

The miniseries has led to a 93% increase in bookings in Ravello, a city about 15 minutes away from Atrani.

The vehicles' failure to detect a "sudden degradation" in the battery could lead to to a sudden loss of power, Ford warns.

Elon Musk's 2018 compensation package is back for board re-certification after being voided by a Delaware court.

Just figuring out what it costs to get a college degree can deter some people from going to school, a new study suggests.

Rideshare passengers have been known to forget all manner of unusual items, from live animals to a car engine.

Receive a $40 Digital Costco Shop Card when you join as a new member at Costco.com when entering PARA24 at checkout.

Give your patio a makeover this spring for just over $200. But hurry -- this outdoor furniture deal might not last.

These deals won't last long.

The first seven jurors have been seated in former President Donald Trump's "hush money" trial in New York. The defense and the prosecution are seeking different types of jurors. CBS News legal analyst Jessica Levinson breaks down the selection process.

A controversial decision by leaders at the University of Southern California relates to the debate raging on many U.S. campuses over the war in Gaza. The school says it's canceling a planned graduation speech by its valedictorian, Asna Tabassum, due to safety concerns. This follows the online response to a pro-Palestinian link that Tabassum posted on her Instagram account.

Department of Homeland Security Secretary Alejandro Mayorkas and Meta's Global Head of Safety Antigone Davis discuss the “Know 2 Protect” campaign. It aims to provide parents and young people with information about how to prevent exploitation and abuse, how to report incidents and provide resources for victims and survivors.

House Speaker Mike Johnson says he will not resign as he faces a new threat of removal by his own party for considering a vote on sending aid to Ukraine. A motion hasn’t been officially filed, but it would only take three Republicans to potentially remove the speaker given the GOP’s shrinking majority, if all Democrats vote against him.

On this edition of CBS Mornings Deals, Elizabeth Werner shows us items that might just become essentials in your everyday life. Visit cbsdeals.com to take advantage of these exclusive deals today. CBS earns commissions on purchases made through cbsdeals.com.

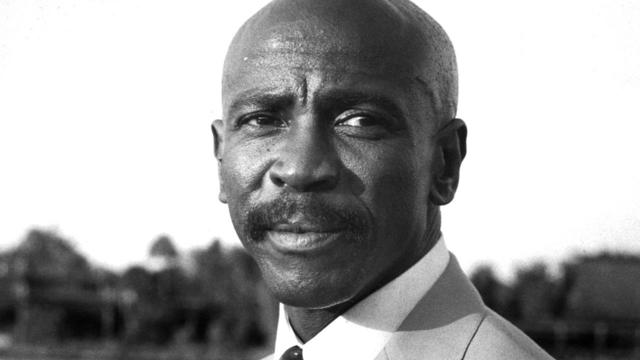

Renowned New Orleans trumpeter Kermit Ruffins, celebrated for his performances on global stages, opens up on how his family's firsthand experience with gun violence has shaped his life and music.

Actor Hilarie Burton Morgan, renowned for her roles in "One Tree Hill" and "White Collar," is back with the second season of her docuseries, "True Crime Story: It Couldn't Happen Here." Each episode delves into a different murder case in small American towns, bringing attention to often-overlooked stories.

Actor and comedian Wayne Brady, a five-time Emmy winner, and award-winning recording artist Deborah Cox join "CBS Mornings" to talk about taking the stage in the new Broadway revival of "The Wiz."

A controversial decision by leaders at the University of Southern California relates to the debate raging on many U.S. campuses over the war in Gaza. The school says it's canceling a planned graduation speech by its valedictorian, Asna Tabassum, due to safety concerns. This follows the online response to a pro-Palestinian link that Tabassum posted on her Instagram account.

Trumpeter Kermit Ruffins has performed around the world, but he's sharing how a personal tragedy involving gun violence has impacted his family and music.

Renowned New Orleans trumpeter Kermit Ruffins, celebrated for his performances on global stages, opens up on how his family's firsthand experience with gun violence has shaped his life and music.

Actor Hilarie Burton Morgan, renowned for her roles in "One Tree Hill" and "White Collar," is back with the second season of her docuseries, "True Crime Story: It Couldn't Happen Here." Each episode delves into a different murder case in small American towns, bringing attention to often-overlooked stories.

Actor and comedian Wayne Brady, a five-time Emmy winner, and award-winning recording artist Deborah Cox join "CBS Mornings" to talk about taking the stage in the new Broadway revival of "The Wiz."

A federal appeals court overturned West Virginia's law barring transgender girls from girls' sports teams, finding that it violates Title IX.

In New York, we tour a unique museum that’s home to an extensive collection of toys, games and playgrounds. Then, we sit down with NBA superstar Steph Curry to discuss his heartwarming new children’s book. Watch these stories and more on "Eye on America" with host Michelle Miller.

In Arizona, we learn why flag football is becoming an increasingly popular sport, especially among girls. Then in New York, we meet with descendants of some of the most notable suffragists of the 20th century. Watch these stories and more on "Eye on America" with host Michelle Miller.

In Connecticut, we meet the preservationists who are giving dilapidated lighthouses new life. Then in California, we learn about the efforts to restore an iconic fishing boat. Watch these stories and more on "Eye on America" with host Michelle Miller.

In Louisiana, we learn how a devastating drought has greatly diminished the area’s crawfish supply. Then in Ohio, we tour a small business that’s seeing promising results from a four-day work week model. Watch these stories and more on Eye on America with host Michelle Miller.

In New York, we speak with the patient and medical team behind the first successful eye transplant. Then in Arizona, we get a firsthand look at a breathing technique that proponents claim can create a healing psychedelic state without any drugs. Watch these stories and more on "Eye on America" with host Michelle Miller.

Spencer, the official mascot of the Boston Marathon, is honored by his community. David Begnaud introduces us to a woman who calls herself a "bad weather friend" – because she's there when you need her most. Plus, more heartwarming stories.

Russ Cook says the scariest part of his run through Africa was "on the back of a motorbike, thinking I was about to die."

A trendsetting third grader creates a school tradition to don dapper outfits on Wednesdays. A retiree makes it her mission to thank those who may be in thankless jobs. Plus, more heartwarming and inspiring stories.

Lyn Story is a retiree whose mission is to be the "bad weather friend," someone who is there for you in a time of need. David Begnaud shows how her huge heart led to life-changing friendships.

Nets star Mikal Bridges fulfills his dream of teaching by working at a school in Brooklyn for the day. A doctor overcomes the odds to help other survivors of catastrophic injuries. Plus, behind the scenes of Drew Barrymore's talk show, and more heartwarming stories.

CBS Reports goes to Illinois, which has one of the highest rates of institutionalization in the country, to understand the challenges families face keeping their developmentally disabled loved ones at home.

As more states legalize gambling, online sportsbooks have spent billions courting the next generation of bettors. And now, as mobile apps offer 24/7 access to placing wagers, addiction groups say more young people are seeking help than ever before. CBS Reports explores what experts say is a hidden epidemic lurking behind a sports betting bonanza that's leaving a trail of broken lives.

In February 2023, a quiet community in Ohio was blindsided by disaster when a train derailed and authorities decided to unleash a plume of toxic smoke in an attempt to avoid an explosion. Days later, residents and the media thought the story was over, but in fact it was just beginning. What unfolded in East Palestine is a cautionary tale for every town and city in America.

In the aftermath of the Supreme Court striking down affirmative action in college admissions, CBS Reports examines the fog of uncertainty for students and administrators who say the decision threatens to unravel decades of progress.

CBS Reports examines the legacy of the U.S. government's terrorist watchlist, 20 years after its inception. In the years since 9/11, the database has grown exponentially to target an estimated 2 million people, while those who believe they were wrongfully added are struggling to clear their names.

The vehicles' failure to detect a "sudden degradation" in the battery could lead to to a sudden loss of power, Ford warns.

A book with records of a U.S. Navy destroyer's trips during World War II was found in a piece of furniture far from the now-sunken ship.

It took decades to identify the remains, and an investigation into the case is still ongoing.

USA Basketball announced its star-studded men's Olympic team for Paris, which includes LeBron James, Stephen Curry, and Kevin Durant.

The miniseries has led to a 93% increase in bookings in Ravello, a city about 15 minutes away from Atrani.

The vehicles' failure to detect a "sudden degradation" in the battery could lead to to a sudden loss of power, Ford warns.

The miniseries has led to a 93% increase in bookings in Ravello, a city about 15 minutes away from Atrani.

Elon Musk's 2018 compensation package is back for board re-certification after being voided by a Delaware court.

Uri Berliner, who has worked at NPR for 25 years, was suspended after he claimed the network pushed progressive viewpoints.

Rideshare passengers have been known to forget all manner of unusual items, from live animals to a car engine.

The Senate is set to convene for the impeachment trial of Secretary Alejandro Mayorkas on Wednesday afternoon, with Democrats aiming to bring the effort to a quick end.

The campaign will work with private and public sector partners to combat rising rates of child exploitation and abuse online.

Democrats who led probes into Trump's role in Jan. 6 Capitol riot expect to face arrest if he wins: "Anybody who has testified against him...should be worried."

At least 24 states have adopted bans on gender-affirming care for minors in recent years, and most of them face legal challenges.

CBS News Confirmed examines three viral claims that have emerged so far during Trump's first criminal trial.

British lawmakers have backed legislation that would see the legal age to buy tobacco increase by one year every year until it's eventually banned.

A new generation of deodorant products promise whole-body odor protection. Should you try one? Dermatologists share what to know.

New York City health officials are warning of a worrisome increase in the number of leptospirosis cases from contact with rat urine.

The $872 million most likely excludes any amount UnitedHealth may have paid to hackers in ransom.

The recall comes years after surgeons say they first noticed problems with the HeartMate II and HeartMate 3, manufactured by Thoratec Corp., a subsidiary of Abbott Laboratories.

British lawmakers have backed legislation that would see the legal age to buy tobacco increase by one year every year until it's eventually banned.

Neither Iran's leaders nor its people appear fearful of an imminent Israeli counterstrike, but they all know the real risks of a war.

It was unclear whether the cold-blooded commuter was venomous or how it ended up on the train, a spokesman said.

Officials reported "volcanic ash rain" as photos and videos show the Ruang volcano filling the night sky with fiery red and orange plumes.

UNICEF says a third of Gaza's infants and toddlers are acutely malnourished, but Israel blames the U.N. itself.

Hilarie Burton Morgan said personal connections to the government and law enforcement communities inspired her involvement in true crime.

Trumpeter Kermit Ruffins has performed around the world, but he's sharing how a personal tragedy involving gun violence has impacted his family and music.

O.J. Simpson's longtime lawyer in Las Vegas says the end came quickly.

Renowned New Orleans trumpeter Kermit Ruffins, celebrated for his performances on global stages, opens up on how his family's firsthand experience with gun violence has shaped his life and music.

The new single, titled "Primrose Hill", was recently released by James McCartney and Sean Ono Lennon, who are both musicians themselves.

The former president's media company announced plans to air news, religious channels and other content.

The Biden administration is awarding Samsung $6.4 billion to expand American chipmaking. The company will spread the money across at least five facilities in Texas. Sujai Shivakumar, senior fellow at the Center for Strategic and International Studies, joins CBS News to assess the economic and technological impacts.

From labor shortages to environmental impacts, farmers are looking to AI to help revolutionize the agriculture industry. One California startup, Farm-ng, is tapping into the power of AI and robotics to perform a wide range of tasks, including seeding, weeding and harvesting.

Roku said Friday a second security breach impacted more than 576,000 accounts after announcing in March that 15,000 accounts had been exposed by a hack. Emma Roth, a writer for The Verge, joins CBS News with more details.

The bill reforms and extends a portion of the Foreign Intelligence Surveillance Act known as Section 702 for a shortened period of two years.

A major global coral bleaching event is occurring for the second time in 10 years, according to the National Oceanic and Atmospheric Administration. Derek Manzello, A coral reef ecologist and NOAA reef watch coordinator, joins CBS News with more.

NASA said it agrees with an independent review board that concluded the project could cost up to $11 billion without major changes.

Only 5 to 6% of plastic waste produced in the U.S. is actually recycled. A new report accuses the plastics industry of a decades-long campaign to "mislead" the public about the viability of recycling.

Mexico City, one of the world's most populated cities with nearly 22 million people, could run out of water in months. Florencia Gonzalez Guerra, an investigative video journalist, joins CBS News to examine the causes behind the crisis.

Greenhouse gas emissions continued increasing in 2023, according to new data from the National Oceanic and Atmospheric Administration. CBS News' Elaine Quijano breaks down the numbers and what they mean for the climate.

A financial counselor for the U.S. Army has admitted to tricking the surviving beneficiaries of fallen soldiers out of millions while profiting himself.

Salvatore Rubino kicked illegal gambling profits to the Genovese crime family, prosecutors say.

An 81-year-old man is charged with murder after thinking the victim was connected to a scam. William Brock received a threatening call last month from someone demanding money. The scammers also called Loletha Hall, an Uber driver, to pick up a package from Brock’s home. Brock confronted Hall with a gun, believing she was connected to the threats. He is now charged with her murder. Warning: The video in this story is disturbing.

Police say one man was killed and three were injured when gunmen on scooters opened fire in the Bronx on Tuesday.

Veronica Butler and Jillian Kelley's disappearance last month prompted a murder investigation that has led to four arrests.

NASA confirmed Monday that a mystery object that crashed through the roof of a Naples, Florida home last month was space junk from equipment discarded by the space station.

NASA said it agrees with an independent review board that concluded the project could cost up to $11 billion without major changes.

It was a "bittersweet moment" as United Launch Alliance brought the Delta program to a close.

NASA flight engineers managed to photograph and videotape the moon's shadow on Earth about 260 miles below them.

Millions of Americans poured into the solar eclipse’s path of totality to watch in wonder. The excitement was shared across generations for the rare celestial event that saw watch parties across the country as almost all of the continental U.S. saw at least a partial solar eclipse.

A look back at the esteemed personalities who've left us this year, who'd touched us with their innovation, creativity and humanity.

The Francis Scott Key Bridge in Baltimore collapsed early Tuesday, March 26 after a column was struck by a container ship that reportedly lost power, sending vehicles and people into the Patapsco River.

When Tiffiney Crawford was found dead inside her van, authorities believed she might have taken her own life. But could she shoot herself twice in the head with her non-dominant hand?

We look back at the life and career of the longtime host of "Sunday Morning," and "one of the most enduring and most endearing" people in broadcasting.

Cayley Mandadi's mother and stepfather go to extreme lengths to prove her death was no accident.

A cat clinging to a car's door handle while submerged in Dubai's floodwaters was rescued as the United Arab Emirates was swamped with its heaviest rain ever recorded. The state-run WAM news agency called the deluge a "historic weather event."

More than 800 people had to evacuate their homes in Indonesia as the Ruang volcano continues its days-long eruption, spewing fiery red clouds as lightning flashes in the sky.

The first seven jurors have been seated in former President Donald Trump's "hush money" trial in New York. The defense and the prosecution are seeking different types of jurors. CBS News legal analyst Jessica Levinson breaks down the selection process.

On this edition of CBS Mornings Deals, Elizabeth Werner shows us items that might just become essentials in your everyday life. Visit cbsdeals.com to take advantage of these exclusive deals today. CBS earns commissions on purchases made through cbsdeals.com.

Renowned New Orleans trumpeter Kermit Ruffins, celebrated for his performances on global stages, opens up on how his family's firsthand experience with gun violence has shaped his life and music.